Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

This February is National Heart Month, a time for each of us to reflect on how we can improve the health of our heart. Living with a heart condition can affect not only the individual but their loved ones too.

Having a heart condition has become one of the most common medical problems among clients who ask us to help them find Life Cover.

Source: British Heart Foundation statistics

Finding Life Insurance that suits your needs can be much harder if you’ve had a heart attack, a cardiac arrest or are living with a heart condition. Moneysworth specialise in helping people find Life Cover even if they have a health condition or have been refused life cover elsewhere.

The most common heart condition we see in our work is a previous heart attack (also known as myocardial infarction). However, over the last seven months, we’ve helped over ninety people with a wide variety of other heart conditions to find life cover. Many of these clients have now successfully started their policy or are currently in the process of applying for cover.

Over the next few weeks, we’re going to post a series of articles about the circumstances behind some of our clients’ search for life cover: why they needed life insurance, the problems they’d previously encountered when trying to apply for cover elsewhere, and the policy options and prices we were able to obtain for them.

It may surprise you to see how people who are living with a serious heart condition – or even multiple conditions – are still able to find cover, thanks to our team’s expert guidance and assistance.

This week is National Obesity Awareness Week – a time to reflect on how being overweight can affect health, how to eat more healthily, and to consider being more physically active.

The risk of developing weight-related health issues is why Life Insurance companies need to know your BMI (body mass index) – a measure that uses your height and weight to work out if your weight is healthy.

Well, it does usually mean the price of the insurance is higher compared to someone with a healthy weight and no other health problems. But you may be surprised to learn that, even with a very high BMI, it’s still possible to get Life Insurance.

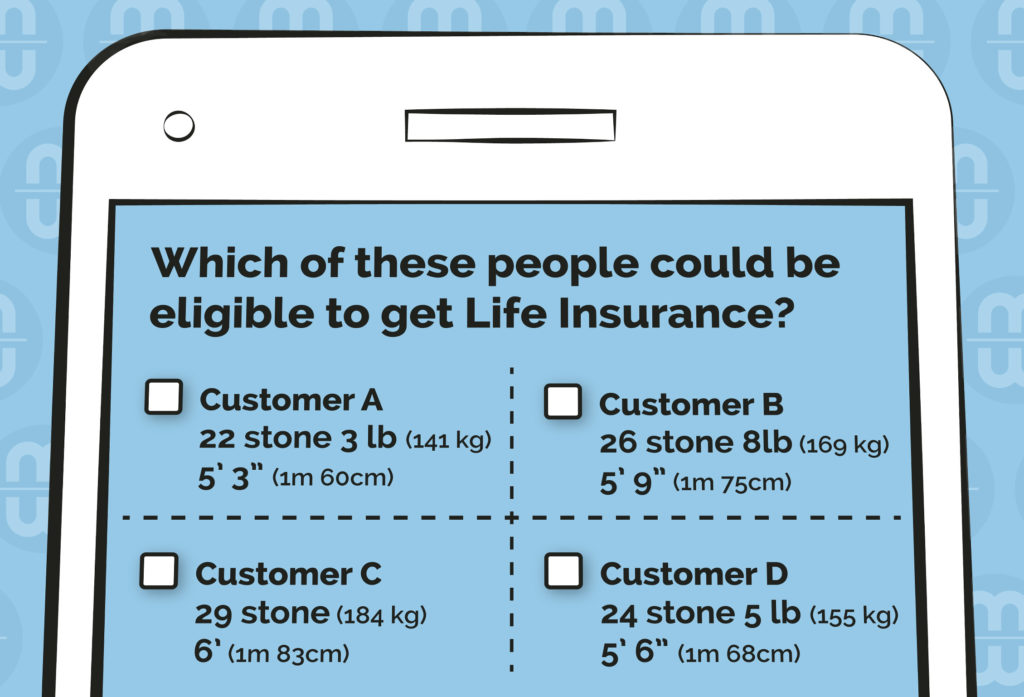

The answer is ALL of them!

Each of the four people has a BMI of 55, which health professionals consider to be in the very high range of obesity levels.

Different insurers set different maximum BMI limits. So, even though these four people have a high BMI, some insurers may offer them Life Cover. That decision, and the price offered, will of course depend on other factors too, such as the applicant’s age, other health conditions and any relevant family medical history.

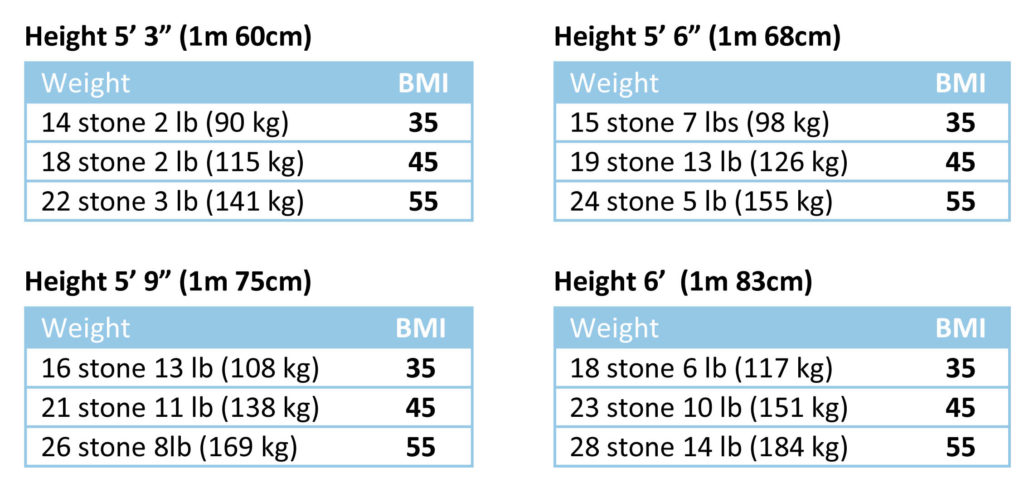

Here’s a range of examples of BMI (Body Mass Index) for adults, who have different heights and weights:

If you know your height and weight, you can use the NHS’s Healthy Weight Calculator to find out your BMI.

Even if you’re still in your 20s or 30s, you feel healthy and high BMI is your only medical issue, you may be charged more for your insurance cover.

This is because insurers don’t just consider your present state of health – they also assess the effect of the raised BMI throughout the proposed term (length) of the insurance cover that you’re asking for.

Recently, we’ve found some insurers who will offer to reduce the monthly cost for your life cover if your BMI improves due to weight loss.

Critical Illness cover and Income Protection cover are typically harder to obtain for people with a high BMI, especially if there are other health conditions to consider. But it may be still be possible for some people – it all comes down to your overall circumstances: BMI, age, other health conditions, family medical history, etc.

Most mainstream insurance companies will have a tolerance level for BMIs up to around 40-45, providing there are no other health conditions present.

If you have other healths conditions too, or have a BMI higher than the mid forties, your search for cover is mostly likely going to be harder.

This is why asking an expert to shop around for you is a good idea. Moneysworth have over fifteen years of success in finding life insurance for people with high BMI and other health conditions. We are usually able to obtain life cover for a maximum of BMI of 55, and in some cases even up to 60. We don’t charge clients any fees to search the insurance market, so it won’t cost you a penny to ask us to fully explore your Life Insurance options.

Learn more about Life Insurance and high BMI / Obesity.

Hello and Welcome!

We are proud to launch our new website which with a great deal of consideration, has taken over a year to develop.

The new site is very different to the old one and we thought it might be useful to explain some of the thinking that has gone into the design and content.

Firstly we were aware that our website had not kept pace with the changes in our business and especially our client groups. Put simply any visitor to the old site might well conclude that our life cover services were designed only for people with pre existing health conditions. However the truth is that we arrange life cover for a much wider range of clients, including people with no health conditions, business owners and clients with occupational and/or overseas travel issues.

Secondly we knew that the old website looked dated and the new site needed a much fresher approach. Financial services websites generally are often criticised for being somewhat dull, so it was important to us that visitors find the new site visually stimulating and engaging.

Our clients receive a bespoke personal service and we wanted the new website to visually send a clear message to visitors, that we are different. We have tried hard to make the site easy to read and visually engaging by breaking information down into manageable amounts. We have used space to de-clutter and chosen a font which feels personable (and different again) and is easier on the eye.

Functionality was another key consideration. We have tried to make the new website easy to navigate and as simple to use as possible. We have tried to make it easy for customers to communicate with us, whether making an enquiry or asking us any questions (e.g. email, phone, live chat). It’s really easy for visitors to share a link to any page they think may be of interest with a friend. Underlying all of this is a clear invitation for visitors to engage with us.

Finally we wanted to create a website that visitors find genuinely useful and compelling. In short we want people to leave our site feeling their visit has been worthwhile and the key issue here is the quality of the content.

Here we have tried as much as possible to put ourselves in the shoes of our clients. We asked ourselves time and time again ‘what are the questions that customers really want answers to?’ ‘How are customers feeling as they approach applying for life insurance?’ ‘What concerns do they have?’ ‘What information might help customers feel more confident’? For example, some people with pre-existing health conditions may fear that life insurance premium rates would be completely unaffordable in their particular situation. They may fear the embarrassment explaining that it was unaffordable. For some these potential negative outcomes might cause them to avoid making any enquiry at all. It is for this reason that we have decided to include a selection of real cases, showing actual premium and cover amounts achieved for some of our customers on the diabetes and heart condition pages of the site. Throughout the website we have similarly tried to include lots of additional information which we think visitors might find useful.

When it comes to life insurance, we believe that what customers are looking for above all, is to feel confident in the decisions they are making. We hope you find our website of genuine value and we look forward to being of service.