Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

This week is National Obesity Awareness Week – a time to reflect on how being overweight can affect health, how to eat more healthily, and to consider being more physically active.

The risk of developing weight-related health issues is why Life Insurance companies need to know your BMI (body mass index) – a measure that uses your height and weight to work out if your weight is healthy.

Well, it does usually mean the price of the insurance is higher compared to someone with a healthy weight and no other health problems. But you may be surprised to learn that, even with a very high BMI, it’s still possible to get Life Insurance.

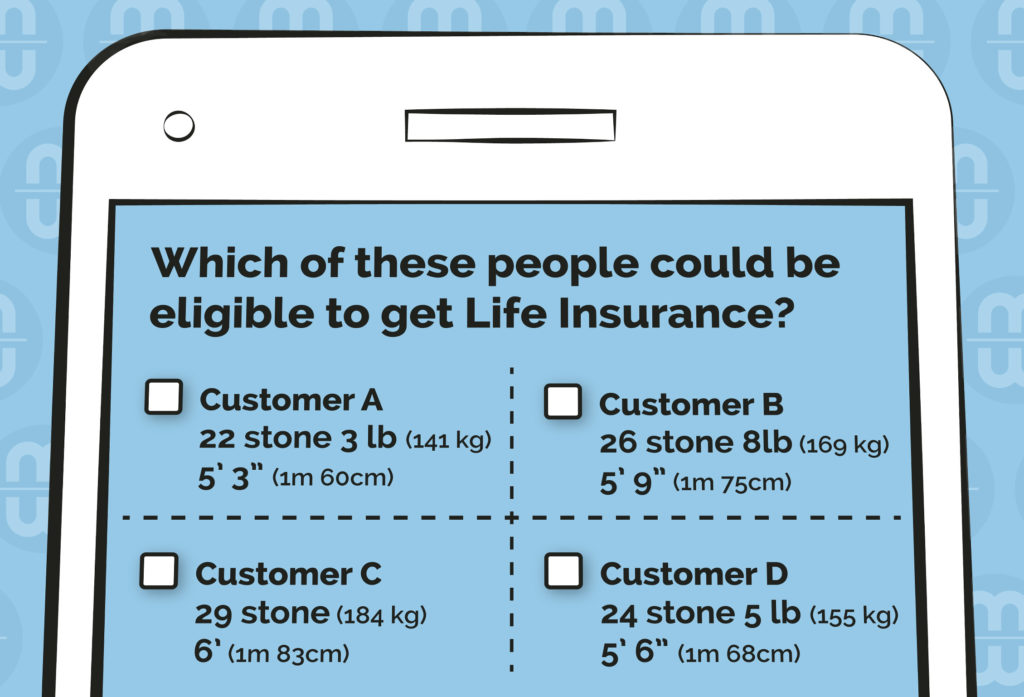

The answer is ALL of them!

Each of the four people has a BMI of 55, which health professionals consider to be in the very high range of obesity levels.

Different insurers set different maximum BMI limits. So, even though these four people have a high BMI, some insurers may offer them Life Cover. That decision, and the price offered, will of course depend on other factors too, such as the applicant’s age, other health conditions and any relevant family medical history.

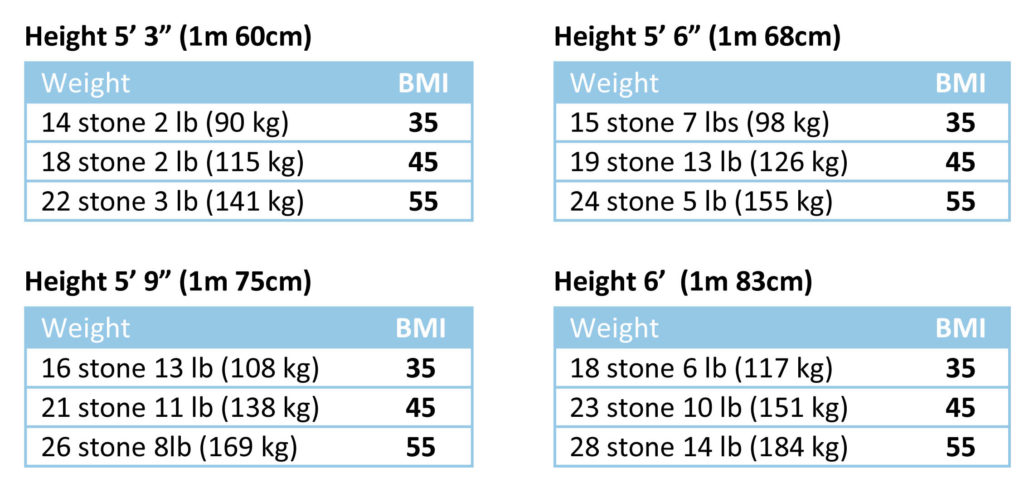

Here’s a range of examples of BMI (Body Mass Index) for adults, who have different heights and weights:

If you know your height and weight, you can use the NHS’s Healthy Weight Calculator to find out your BMI.

Even if you’re still in your 20s or 30s, you feel healthy and high BMI is your only medical issue, you may be charged more for your insurance cover.

This is because insurers don’t just consider your present state of health – they also assess the effect of the raised BMI throughout the proposed term (length) of the insurance cover that you’re asking for.

Recently, we’ve found some insurers who will offer to reduce the monthly cost for your life cover if your BMI improves due to weight loss.

Critical Illness cover and Income Protection cover are typically harder to obtain for people with a high BMI, especially if there are other health conditions to consider. But it may be still be possible for some people – it all comes down to your overall circumstances: BMI, age, other health conditions, family medical history, etc.

Most mainstream insurance companies will have a tolerance level for BMIs up to around 40-45, providing there are no other health conditions present.

If you have other healths conditions too, or have a BMI higher than the mid forties, your search for cover is mostly likely going to be harder.

This is why asking an expert to shop around for you is a good idea. Moneysworth have over fifteen years of success in finding life insurance for people with high BMI and other health conditions. We are usually able to obtain life cover for a maximum of BMI of 55, and in some cases even up to 60. We don’t charge clients any fees to search the insurance market, so it won’t cost you a penny to ask us to fully explore your Life Insurance options.

Learn more about Life Insurance and high BMI / Obesity.

Having type 1 or type 2 diabetes often makes it harder or even impossible to find suitable Life Cover, Critical Illness Cover and Income Protection.

Life insurance companies typically have a range of different premium rates for people with diabetes. Different companies will place the same person in different price bands. The process of applying for cover can often take weeks – or even months – if medical reports need to be obtained and checked. And although the situation has somewhat improved for Life Cover in recent years, most insurers are still unwilling to consider Critical Illness or Income Protection for people with any type of diabetes.

Well, there’s definitely some good news here.

In recent years, we’ve seen improvements in the prices for Life Cover typically offered to people with diabetes.

Another encouraging development we’ve seen with a couple of insurers: after starting the life insurance policy, the insurers reward policyholders by reducing premiums if the customer can demonstrate improved control (i.e. if their HbA1c reading comes down by a certain amount). We think this is a very encouraging sign, not just because it can make cover cheaper, but because it demonstrates that the insurance market is starting to consider how to adapt to the unique circumstances of people with long-term health conditions.

If certain criteria are met, it’s now possible for people living with diabetes to get a “fast-track” application, which means cover could be in place immediately. Less stress, more peace of mind – exactly the kind of innovation we want to see for people with long-term health conditions who want to protect their financial security and their family’s future.

A year ago, there were hardly any options for people with diabetes to obtain Income Protection Insurance. For most it simply wasn’t available.

Moneysworth campaigned to improve that situation, and we’re pleased to see at least some people in the insurance industry listened to us!

With expert guidance, it’s now possible for some people who have type 2 diabetes to get Income Protection with no exclusions, subject to certain criteria. But for people with type 1 diabetes, although there is some availability, it’s extremely limited.

The situation for Critical Illness Cover has been slow to improve. It is now possible for people living with diabetes to obtain Critical Illness Cover – but the options are very limited and the chances of being offered cover are even narrower if they have type 1.

The small signs of progress we’ve seen in the market are a welcome start, but the fact is most insurance companies still don’t offer either of these protection products to people who have diabetes.

The charity Diabetes UK reports that there are around 3.7 million people who have been diagnosed with diabetes in the UK, and that figure is predicted to rise to 5 million by 2025*.

In light of this, we firmly believe that the insurance market needs a surge of innovation to make its products and services more forward-thinking and inclusive.

Moneysworth wants to see cover options and availability broaden for people living with diabetes, and so we’ll continue to lobby the insurance industry.

* Source: Diabetes UK ‘Facts & Figures‘

We’ll be heading to London this week for the prestigious Health Insurance Intermediary Awards where we’re finalists in two categories.

We’ve made the shortlist in the following categories:

As an intermediary specialising in helping those who may be considered high risk for insurance, we’re delighted to feature in these shortlists against some great competition.

The awards will be taking place at London’s Grosvenor House on Thursday 15th October 2015 with over 900 industry professionals and experts expected to be there.

Wish us luck!

Obtaining Critical Illness cover for anyone with Type 2 Diabetes can be very difficult, but it is possible in some circumstances, as one of our recent cases demonstrates.

The first problem is that most insurance companies will automatically decline any application for Critical Illness cover from a person with Type 2 diabetes, irrespective of positive factors, such as good control and lack of complications. So it’s difficult for consumers to know where to go.

Normally buying life insurance and critical illness cover can be done in many places like the bank, large comparison websites and financial advisers, however if your personal circumstances mean that you do not fit the standard mould, you would be well advised to use the services of a life insurance broker who has particular specialisation in dealing with people who have health conditions.

Moneysworth has been successful in arranging Life and Critical Illness cover on a number of occasions for people with Type 2 Diabetes, as a recent case demonstrates.

A gentleman in his early 40’s made an enquiry on our website: www.moneysworth.co.uk. Type 2 Diabetes had relatively recently been diagnosed, his control was good and he didn’t have any diabetic complications, but he was overweight. With a raised BMI (Body Mass Index) of 31, this made finding cover even more difficult. He wanted Life and Critical Illness cover and had a specific budget in mind for his premiums of £75 per month.

As we do in all cases, we researched the whole market for the client to see if life and critical illness cover would be available. Our research indicated that only one insurance company would offer him cover, so we applied to them. The insurer wrote to his GP surgery for further medical information and on receipt of that offered a guaranteed premium policy for £75 per month, covering the client for Level Life or Critical Illness cover (without exclusions) of £75,350 over 23 years.

People with an existing health condition who have been declined elsewhere should not give up hope of getting the cover they want until they have used the services of a specialist life insurance broker. If a client wants to find out what might be available and apply, Moneysworth do not charge a fee. This means Moneysworth is only paid a commission by an insurer if we are successful. Remember if you’re unsure if a broker is a specialist, you could ask the question: ‘What percentage of your clients have pre-existing health conditions?’. At Moneysworth that figure is over 75%!

We have just received the following email from a new client.

”Just to let you know, your company has been really responsive and kept me well informed hence the reason I trust you to provide me with the life insurance. Another competitor just called and after many excuses why they were late to come back to me they also said Aegon can insure me but I decline as you guys were faster, and far better in my mind (the other lot tried to come over the phone in a very posh manner which does not mean anything to me, service is the key!). Happy for you to share this with your colleagues and if required please post online as I am a happy customer”

Like all companies we are always pleased when our hard efforts to provide good service are recognised by our customers.

Through good service we’ve earned trust and ‘Trust’ is what our clients are looking for.

On 2nd December Jill Insley wrote an article ( http://t.co/1Cx2wAzR ) in The Observer about Nic Hughes whose critical illness claim has been turned down by Friends Life. A campaign has started to get Friends Life to overturn their decision and backed by @stephenfry on twitter the campaign is set to gain momentum.

We have decided to support the campaign and we want to explain our reasons why.

As we have previously expressed, we have had concerns for some time that the way that life insurance companies currently work may be leaving some customers exposed to the danger of a claim being turned down. When it comes to critical illness and life insurance there can be nothing worse than thinking you have done the right thing and protected your family with personal insurance cover only to find out when its too late that the insurance company has thrown out the claim due to ‘non disclosure’.

We accept that there are some occasions where due to deliberate non disclosure an insurance company will be quite within their rights to decline a claim.

However we believe there currently exists a grey area where it is much less clear that a customer has deliberately non disclosed. Misunderstandings concerning disclosure can and do arise and in the case of Nic Hughes it looks as though this might have been part of the problem.

We believe that the current underwriting practices used by most life insurance companies are adding to this problem. This is because most life companies often deliberately make the decision not to write for further medical information from the client’s GP at the application stage, even though the client might have disclosed one or more medical conditions on the application form. For medical disclosures such as heart disease and cancer, life insurance companies will nearly always prefer to write out to the client’s GP for further medical information. But there are many potentially ‘less serious’ conditions where the insurance company may decide not to bother with this stage of the process and to offer acceptance terms straight away. In fact life insurance companies adopt this approach for the majority of applications.

The problem is that where there is no independent medical verification there can be an increased risk of misunderstanding and therefore of a claim being declined, which is potentially catastrophic for the policy holder.

Life insurance companies argue that if they were to write out for medical evidence in a greater number of cases that this would add to their costs and that it would delay customers obtaining cover. They say that customers want cover quickly and that if they can’t get it quickly they will be put off taking out insurance.

We disagree strongly and so do most of our clients. We think that the argument that the ‘client needs a fast turnaround’ is a smoke screen and that there may be other motivating factors.

Here @MoneysworthUK our clients tell us that the most important thing for them is to know that their cover is valid. Getting the job done right is much more important than getting a quick fix. In the main they positively welcome a GP report as part of the underwriting process, because it makes them feel safer that they haven’t accidentally left something out. That’s probably not surprising when you consider that the majority of our clients already have an existing health condition such as diabetes, heart disease, mental health etc.

In the case of Nic Hughes, had the life insurance company written out to the client’s GP for a report before making their underwriting decision then the current situation could have been avoided. If they had declined or postponed cover then Nic could have explored other avenues to see if other options were available. Instead of which the insurance company seems to have taken the easy route which has turned out to be easy for them but very difficult for Nic and for his family.

In Nic’s case we think Friends Life should settle the claim. If you would like to sign the petition here is the link https://t.co/7KlFyuOL

Furthermore we think that Nic’s case illustrates the need for a reassessment of underwriting procedures across all life insurance companies. One possible way of dealing with this issue would be to make insurance companies fully liable for claims arising after a limited initial period – that would change the way life insurance companies approached their underwriting processes as they would not be able to rely on non disclosure at the claim stage. But it would leave customers knowing where they stand.

In the meantime until life insurance companies change their ways we think that ‘grey’ cases should be settled in favour of the applicants.