Moneysworth wins Best Small Protection Advice Firm 2023!

Learn more

Call us 01625 462 744

In our previous article, we gave an example of how charity signposting works. A young father with a lifelong heart condition tried for over two years to find an insurer willing to offer him Life Cover. Then a UK heart charity providing him with a list of brokers who specialise in assisting people with health conditions to find suitable insurance.

Likewise, a growing number of financial advisors now signpost to us when they have clients whose health condition is deemed to be higher risk, and the firm struggles to find an insurer willing to offer Life Cover to those clients.

Heart conditions and circulatory conditions are among the most common health conditions we see in the clients referred to us by financial advisors.

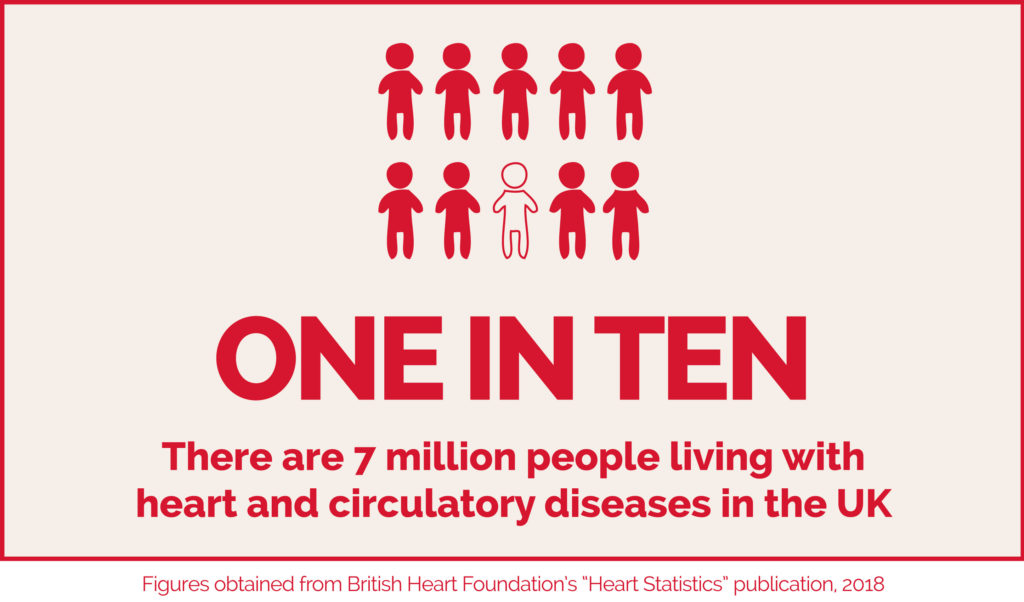

There are currently around 7 million people living with heart and circulatory diseases in the UK – that’s over 10 percent of the population[1]. An ageing and growing population and improved survival rates from heart and circulatory events (such as heart attack) could see this number increase in years to come. From conversations we have with clients, we know that many people wrongly assume that their heart condition automatically means they aren’t eligible to get any Life Insurance.

Around 80 percent of people with heart and circulatory diseases have at least one other health condition[1], which makes it even harder for these people to find an insurer willing to offer them Life Insurance, even with the help of their financial advisor.

Financial advisors don’t want to tell their clients they are uninsurable. This is why a growing number of financial advisor firms have an arrangement with specialist brokers like Moneysworth to handle their declined Life Insurance cases.

They care about their clients and realise they have a duty of care to help them find the insurance they need, even if that means referring the client to a specialist broker. This duty of care is the key reason why financial advisors should have contingency plans for signposting their clients to a specialist.

The financial advisors who come to us rely on our specialist expertise. Our careful research not only helps to ensure their client has the best chance of being offered cover, but quite often results in that cover being offered at a surprisingly affordable price.

Most important of all, our comprehensive approach also means the client can feel that the insurance cover they’ve purchased is fit for purpose so that – if the worst happens – the policy will pay out.

A financial advisor firm recently approached us having tried, unsuccessfully, to find Life Cover for their client who has a heart condition.

The client is a male in his early forties who was diagnosed with Cardiomyopathy over ten years ago. Cardiomyopathy is a disease of the heart muscle which affects its size, shape and structure.

At this time, he was also fitted with an ICD (Implantable Cardioverter Defibrillator) – a life-saving device which is surgically implanted inside a patient’s chest if their cardiologist believes there is a real risk that the heart could suddenly stop beating. An ICD is a defibrillator that automatically detects if the heart stops and immediately shocks the heart to start it beating again.

The client has annual medical reviews and, despite the seriousness of his heart condition, he has no symptoms whatsoever.

We were not surprised that the client and his financial advisor had experienced difficulty in finding an insurer willing to offer cover. We knew that the majority of Life Insurance companies will decline an application where an ICD had been fitted – especially given the underlying heart condition diagnosed at such a relatively young age.

When we completed our research for this case, virtually all insurers in the marketplace confirmed they would decline an application for Life Insurance. But because we were thorough, we found two insurance companies willing to give further consideration to an application, subject to seeing a GP report.

With the client’s permission, these two insurers obtained a GP report including a letter from the cardiologist.

One of these insurers then declined the application, but the other offered mortgage term assurance with no exclusions and for the full sum the client needed (over £200,000) for the whole term of the mortgage (over 20 years) for less than £100 per month.

A satisfying result for us, for the financial advisor and for their client!

Notes:

1. Figures obtained from British Heart Foundation’s “Heart Statistics” publication, 2018: https://www.bhf.org.uk/what-we-do/our-research/heart-statistics

‘There’s nothing worse than an ex-smoker’ it’s said so I’ll start by fessing up to a previous habit. My purpose is not to moralise on the subject (we all make our own choices anyway), I simply want to look at how insurance companies currently view smoking and diabetes. Also just before I get going I should point out that we at Moneysworth help both smoking and non smoking diabetics to obtain life cover, day in day out.

It may seem a bit obvious but we and the life companies all know, as it says on our the packets, that smoking is bad for our health. As mentioned in previous blogs not only do life companies charge significantly higher premiums for smoking, the price differential has been increasing over the years too.

So what about diabetes and smoking? Well did you know that some life companies not only charge extra for both being diabetic and for smoking but also make a further third charge for smoking AND having diabetes? We also know of one major insurance company who automatically decline all type 1 diabetic smokers, regardless of how good the rest of their profile.

So why the nervousness? It’s all to do with cardio vascular risks. Diabetics are at increased risk of cardio vascular events and of course unfortunately diabetes is a progessive illness. Doctors are therefore keen to identify and manage key cardio vascular risk factors in their diabetic patients. Key factors include BMI and a family history of early diagnosis of heart conditions. Many diabetics take statins and in a significant amount of cases this is not due to the patient having a cholesterol problem, but to make sure that they don’t develop one in the future, as this would again provide an additional cardio vascular risk. Blood pressure is another key factor.

Perhaps to some readers the risk of cardio vascular complications for the diabetic does not seem too important or immediate. I would urge such readers to think again. Firstly and most obviously a lot of people do die of heart attacks – and for these the warning signs often come too late ornot at all. Secondly for those diabetics who do manage to survive a heart attack or who are diagnosed with angina for example, the chances of obtaining new life cover currently reduce to nil with all the major UK life companies. I will return to this issue in a later blog.

In the meantime what can smoking diabetics expect when applying for life cover? The truth is that many of them can expect to be declined by a lot of companies. You will save yourself a lot of time and heartache if you use the services of a broker who really specialises in health conditions.

The significance of smoking for Type 2 sufferers who apply for life cover will depend upon the number and seriousness of other additional (especially cardio vascular) risk factors present as well as the level of smoking. At the very least the premiums will be significantly more expensive and at worst the applicant might struggle to get any life cover at all.

For Type 1 sufferers smoking is even worse and applications are even more likely to end in declinature. The reason why is as follows. Type 1 sufferers tend to have already been living with diabetes for a lot longer than the average Type 2 sufferer who is seeking life cover. This means that they generally start at higher rating bands to begin with. This also means that there is less room for the insurance companies to play with in terms of adding extra amounts of ratings for extra complications, before the cases turn into a ‘decline’. It is still possible for some type 1 diabetic smokers to obtain life cover but its more difficult than for type 2 diabetics.

The news for diabetics who are able to give up smoking for at least 12 months is generally more positive as they can still be treated as non smokers by the life companies. Stopping smoking is likely to result in a more favourable attidue from life companies and cheaper premiums.

So in summary our advice for smoking diabetics is

1) Do seriously consider giving up smoking if at all possible, most importantly it will improve your health in the long term and save you a lot of money.

2) When you give up smoking for 12 months do expect life assurance companies to seek to verify this by way of a cotinine test.

3) Don’t however delay purchasing life cover in the meantime. Waiting until you have stopped smoking for 12 months before applying for life cover may leave your family with little or no protection and the prospect of losing the family home. Its better to find cover now and protect your family even if you apply for a lesser am,ount of cover than you would ideally like. Most people will still stand a good chance of benefitting from reduced premiums when you have stopped smoking for 12 months anyway.

4) Use a specialist broker rather than trying to arrnage the life cover yourself – its quicker and you are likely to get a better result. But make sure the broker really is specialist in arranging life cover for diabetics first.

5) If you think it is unlikely that you will choose to stop smoking in the foreseeable future, then work on the basis that it will become more difficult and more expensive to obtain life cover in the future. Get covered now and keep hold of it!